Car allowance tax calculator

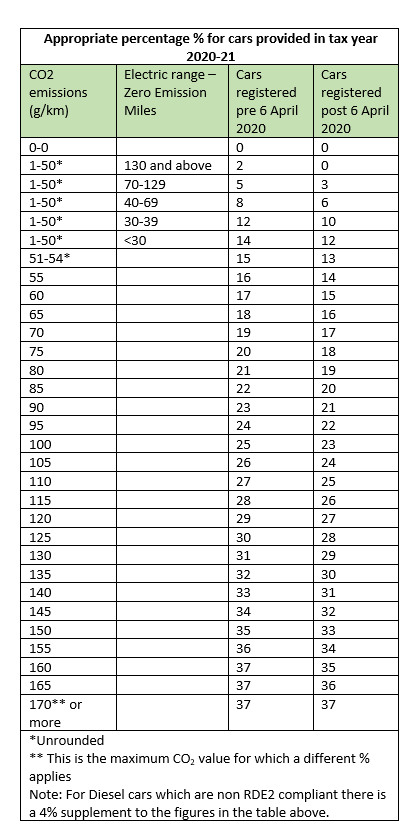

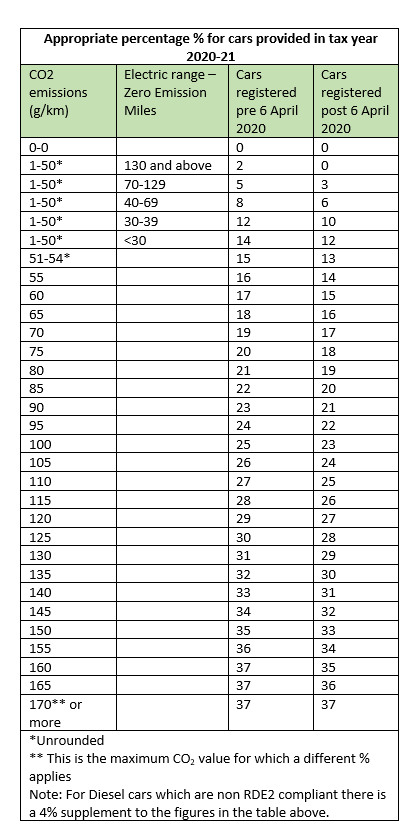

The tax rate varies depending on if the vehicle is petrol or diesel electric or alternative for example hybrid vehicles. 5 of VAT inclusive cost of the car.

How To Calculate A Fair Car Allowance

Vehicles with an original list price of more than 40000 will also.

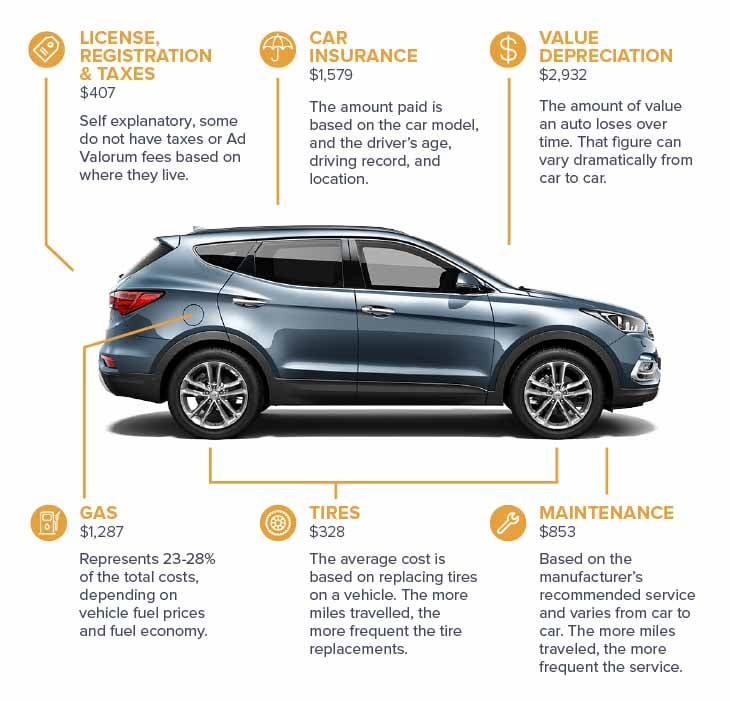

. As amended upto Finance Act 2022. The mobile worker then gets a car allowance in the amount of the mileage multiplied by the millage rate. Fuel costs and employer provided private fuel Another important cost that you will need to consider when selecting a new car is fuelling.

Income Tax Department Tax Tools MotorCar Calculator. Company Car Tax Calculator Tax Calculators Personal Tax Calculate the company car tax and any fuel benefit charge on your actual income. CAR TAX CALCULATOR 1.

Monthly value of the use of the car for tax is 3. 8200 for senior managers. Work-related car expenses calculator.

Select the nature of. And that too at a rate of 20 per cent on the amount in excess of 12750. Taxability of Motor Car Perquisite.

Car allowance is based on the cost plus VAT x 35 without maintenance x number of. Tax payments 3. A tax calculator and car allowance claim calculator for SA Income Tax for South Africans The online Tax Calculator and Car Allowance Calculator for the South African Salary.

2022 Car Allowance Calculator 01 March 2021 - 28 February 2022 Car value. You can calculate taxable value using commercial payroll software. Taxability of other than Car Perquisite.

If you earn 90000 pa and your employer grants you a 10000 car allowance you will be taxed 3700 additional to the 20797 you would owe the ATO without a car allowance. Just select your vehicle or enter the P11D value and. 10300 for company heads directors c-suite individuals.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. To use HMRCs company car tax calculator click here. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you.

Such amount is tax-free if it does not exceed the IRS business rate which is. An allowance paid to an employee is taxable income and tax is required to be withheld from. Tax calculator 2022.

Car tax rates are based on fuel type and CO 2. As a general rule 80 of your travel allowance is subject to monthly PAYE. Hit the green button.

It can be used for the 201314 to. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser. Calculate your 2022 car allowance A better approach would be to try our allowance calculator which will lead to the creation of a free recommended allowance or rate.

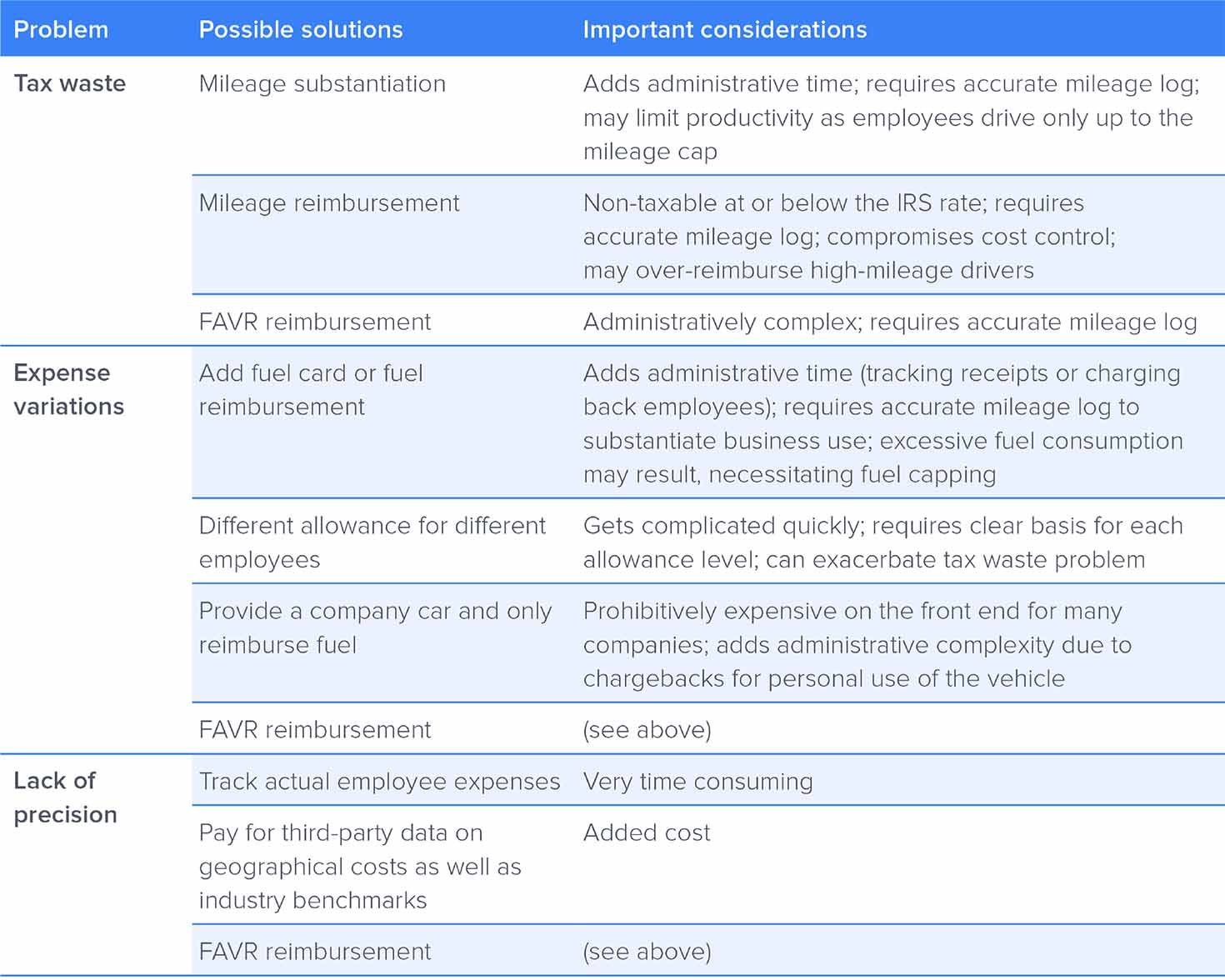

Student loan pension contributions bonuses company. Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is correct in your example salary 70000 pension 514. Payment of a car allowance gives rise to a number of tax questions.

A recent survey found that the average car allowance in the UK is as follows. This means your Personal Allowance of 12750 will first be deducted before taxes are applied. For a car allowance of 500 per month that.

Your results You can use this service to calculate tax rates for new unregistered cars. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Car Allowance Tax Rebate Calculator The Thai governments Auto Taxation Refund structure was introduced in Sept 2011 and aided many people get their very first cars.

So for the vast majority of employees who are offered a car allowance theyll pay either 20 or 40 of the allowance in income tax. This is based on the assumption that you spend 80 of your travel time for personal reasons and only.

Car Allowance Salary Sacrifice Or Company Car Free Comparison Calculator Download Youtube

2022 Everything You Need To Know About Car Allowances

2022 Everything You Need To Know About Car Allowances

Is Car Allowance Taxable Under Irs Rules I T E Policy I

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

Car Allowance Vs Mileage Reimbursement

2022 Car Allowance Policy Calculate The Right Amount

How To Get A Tax Benefit For Buying A New Car Axis Bank

2022 Car Allowance Policy Calculate The Right Amount

Company Car Or Car Allowance What Do I Choose Youtube

Allowance Vs Cent Per Mile Reimbursement Which Is Better

What Is The Average Car Allowance For Executives I T E Policy I

Car Benefits Data Input Calculation 2020 21 Moneysoft

A Guide To Company Car Tax For Electric Cars Clm

2022 Everything You Need To Know About Car Allowances

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Should You Take A Company Car Or A Car Allowance